In 1972, the Commonwealth of Virginia adopted a Use Value Taxation Program for the "preservation of real estate for agricultural, horticultural, forest and open space use in the public interest."1 In 1972, the Commonwealth of Virginia adopted a Use Value Taxation Program for the "preservation of real estate for agricultural, horticultural, forest and open space use in the public interest."1

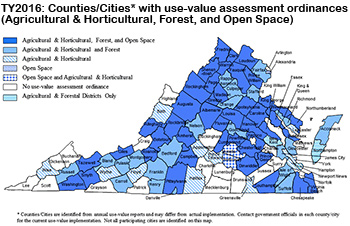

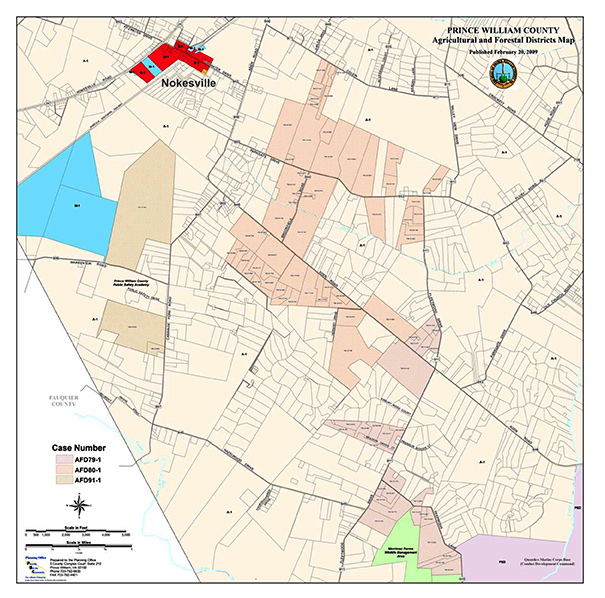

In 1979, the Prince William County Board of County Supervisors created the first Agricultural and Forestal District in Northern Virginia, two years after the General Assembly authorized such districts. The County's local land use assessment program was already in place before creation of that first district. By 2016, most Virginia counties had implemented some form of the use assessment program.2

The Prince William program has always provided for use value assessment for open space, as well as agricultural and forest use. The minimum acreage requirements are:3

- Real estate devoted to agricultural or horticultural use shall consist of a minimum of five acres

- Real estate devoted to forest use shall consist of a minimum of 20 acres

- Real estate devoted to open space use shall consist of a minimum of 20 acres

Land in the use value program qualifies for deferred taxation. Instead of calculating real estate values based on the "highest and best use," often for development of housing, tax assessors calculate the land value based on actual use.

Lowering real estate taxes is designed to encourage landowners to maintain their property in an undeveloped state, rather than seek speculative profits through development. Lowering real estate taxes is designed to encourage landowners to maintain their property in an undeveloped state, rather than seek speculative profits through development.

Land within Agricultural and Forestal Districts also gains protection against unreasonable restrictions on agricultural or forestry use, assessments or special tax levies, and condemnation through eminent domain.

Creation of such districts is intended to incentivize multiple landowners, including those who do not own large parcels, to participate in the use value assessment program.4 If landowners choose to remove their property from the use value assessment program, they must pay five years of "rollback" taxes and then future taxes are based on fair market value. The rollback tax is the difference in taxes from use value vs fair market value.

Not all farms in Prince William County participate in the use value assessment program. According to Prince William's 2014 Real Estate Assessment Annual Report, 84 properties covering 34,222 acres are enrolled in the Land Use program. The total amount of deferred taxes in 2014 was $4,656,296.5

The public benefits from the use value assessment program, offsetting the reduction in taxes.

The Rural Area was established in the 1998 Comprehensive Plan because citizens were frustrated by the steady increase in real estate taxes as the county suburbanized further in the 1990's.

County supervisors recognized that the cost of providing public services could be reduced by focusing new public infrastructure within a Development Area. It would be cost-effective to build roads (funded at the time with local bonds), schools, libraries, fire/rescue stations, and other public infrastructure where population was concentrated. It would be more expensive to build such facilities in the Rural Area, where residents were scattered.

The supervisors adopted a Comprehensive Plan that allowed some new development in the Rural Area, but constrained it by establishing a 10-acre zoning minimum for new residential lots and encouraging productive use of the open space for agriculture and forest management.

More than farmers benefit from the use value assessment program. Today, residents of the Development Area are strong supporters of maintaining the Rural Area. They recognize:

- Long-term benefits of building cost-effective "capital improvements," keeping taxes low

- Current quality of life benefits, having access to open space and local food production, as farm-to-table restaurants increase demand

- Long-term economic development potential from maintaining an area with low-density development, which is attractive to the workforce of the types of companies that the Department of Economic Development seeks to attract to Price William

Prince William County could increase the economic development benefits from the Rural Area by incentivizing more agricultural activity. Bona fide farming operations are possible on less than five acres, as demonstrated by the True Farm hydroponics business. Updating the use value assessment program to include small-acre farming would help create the special sense of place that matches the vision in the Strategic Plan:6

"Prince William County is a community of choice with a strong, diverse economic base, where individuals and families choose to live and work and businesses choose to locate."

Read more on Conservation, Land Use and Transportation

References

1. "A Citizens' Guide to The Use Value Taxation Program in Virginia," Virginia Cooperative Extension, Publication 448-037, May 1, (last checked April 20, 2016)

2. "Prince William Approves Plan To Protect County Farmland," Washington Post, October 18, 1979; "Virginia's Use Value Assessment Program," Department of Agricultural and Applied Economics, Virginia Tech,http://www.usevalue.agecon.vt.edu/TY2016_Use-value%20Map.htm (last checked April 20, 2016)

3. "Sec. 26-18. - Determination of use value and assessment by director of finance," Municipal Code, Prince William County, (last checked April 20, 2016)

4. "What is the difference between agricultural and forestal districts and use-value taxation?," Frequently Asked Questions (FAQs) about Virginia's Use Value Assessment Program, August 13, 2015, "Virginia's Use Value Assessment Program," Department of Agricultural and Applied Economics, Virginia Tech, (last checked April 20, 2016)

5. Prince William County 2014 Real Estate Assessment Annual Report

6. "2013-2016 Strategic Plan," Prince William County, p.7, (last checked April 20, 2016) |